Epf Dividend Rate 2018

To EPF An employee contributes around 12 of his SalaryBasic DA and cash value of food allowances which is matched by the employerOur article SalaryAllowancesDearness AllowanceGovernment Salary Pay Commission explains components of salary like Basic DADearness allowance in detail. Salary for January 2018.

Historical Epf Dividend Rates From 1983 2020 The Money Magnet

Epf Dividend Of 5 Possible 6 May Be Difficult The Edge Markets

3 Key Things You Need To Know About Employees Provident Fund Epf

In EPS only the employer contributes.

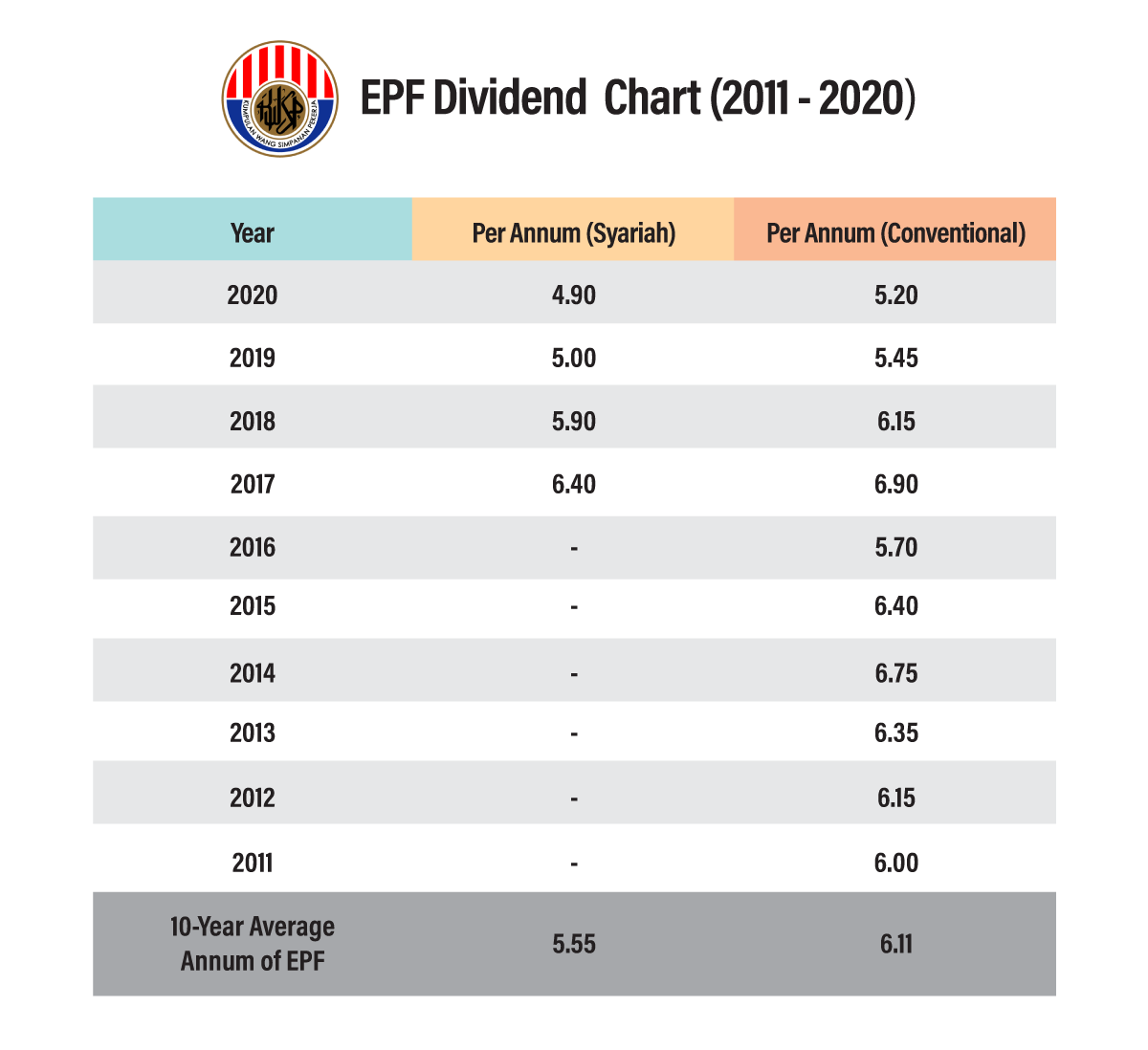

Epf dividend rate 2018. Dividend Paying Mutual Funds. Hercules Hoists - Intimation Of AGM Dividend Rate E-Voting Period And Book Closure Date. The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952.

As per this amendment from 1st April 2021 onwards the interest on any. The last rate that you opt for will be your new contribution rate and will remain as so until you andor your. The rate of inflation for indexation purposes is specified by.

Income Tax Act 1961 is a statute that lays the basis of tax payments in India. Sundaram Mid Cap Fund - Direct Plan Jun 29th 2021 3073 Sundaram Mid Cap Fund Jun 29th 2021 2873 Sundaram Mid Cap Fund - Institutional. So EPS still needs to be submitted to EPFO.

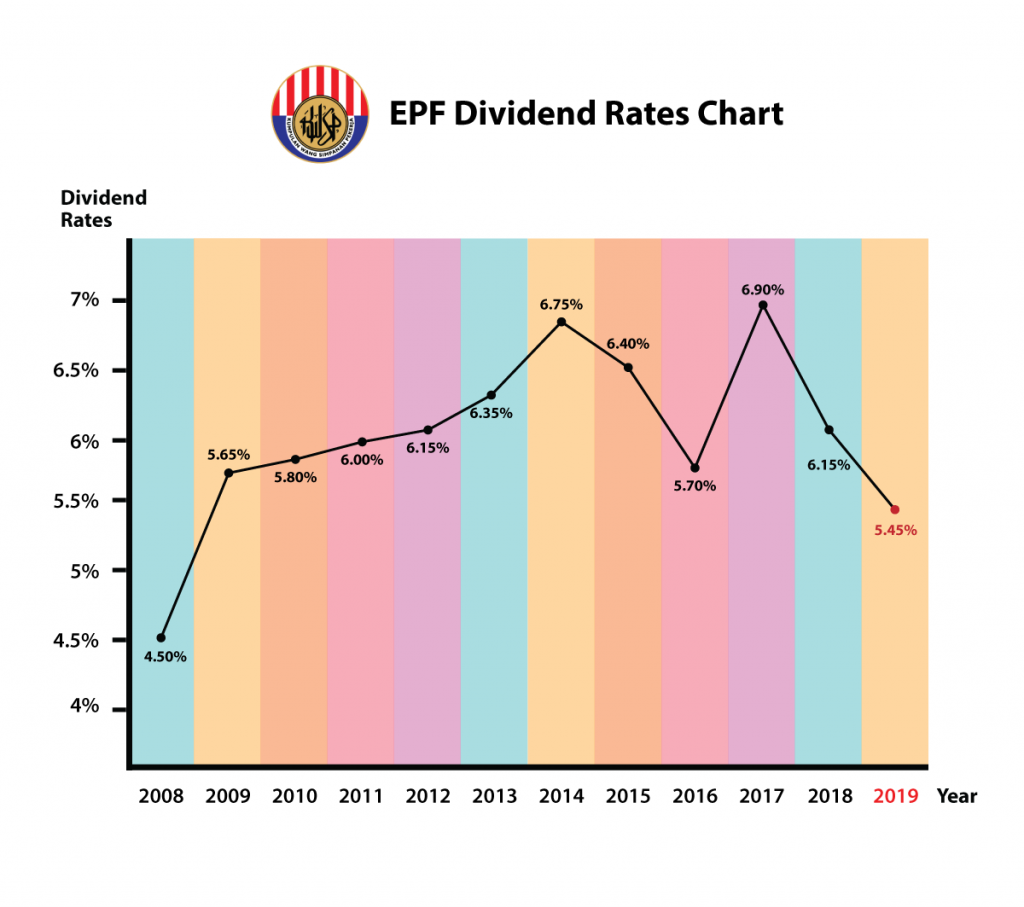

6 The EPF claims that the lowered dividend is the result of its decision to invest in low-risk fixed revenue instruments which produce lower returns but maintains the principal value of its members contributions. However the pension or EPS is payable only by the EPFO. May choose to contribute more than the stipulated rates under the Third Schedule to the EPF Act 1991.

No shake up disruption as banks alrdy providing digital banking svcs for a few yrs now. For the previous FY 2020-21 CII value was 301. If FD risk free rate is 8 a year then dividend yield of no lesser than 9 per year can be considered good.

Dividend income from mutual funds or stocks commission rent. Payment of Dividend on which Dividend. During his tenure he launched.

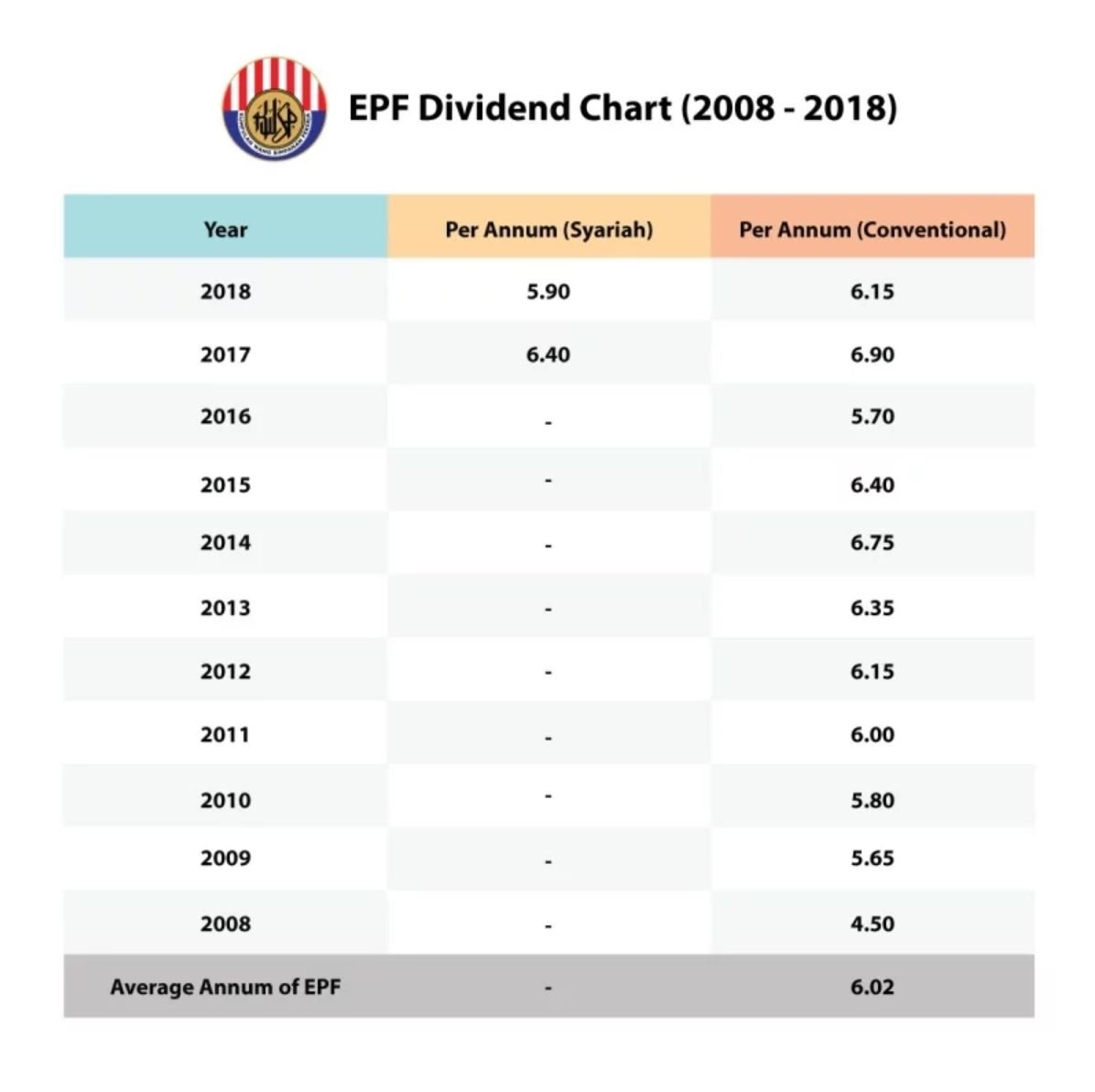

10000-For GOI Taxable Bonds. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. EPF Dividend Rate.

Rural with too few physical customers. Say if FD rate is 270 then stocks dividend of 3 or above is good. Answer varies depending on the current Fixed Deposit FD rate.

These mutual funds refer to stock mutual funds that chiefly invest in organizations that offer dividends. Union finance minister Nirmala Sitharaman on. EPF Trusts opens and maintains PF accounts of the employees.

Book closure date will be August 3. Premature withdrawal from EPF AC before 5 Years completion time as the subscriber. 193 2500- For Int.

For newcomers it is a new mkt indy to tap into. Rent Dividend Bank Interest Fixed Deposit EPF. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952.

Interest on employees share of contribution to Employees Provident Fund EPF on or after April 1 2021 will be taxable at the stage of withdrawal if it exceeds 25 lakh. Form 15G Form 15H. Legally the EPF is only obligated to provide 25 dividends as per Section 27 of the Employees Provident Fund Act 1991.

May 20 June 20 July 20. An evolution not revolution process. The Act provides absolute guideline for determination of taxability in IndiaAs per the Act all people and artificial entities residing in India be it individual proprietary firm a partnership firm or a company is subject to abide by the Income Tax Act and need to pay tax and submit an annual Income Tax return.

EPF and EPS Wages. Income Tax Slabs for Assessment Year 2019-2020. Latest TDS Rates FY 2020-21 Table.

1invest1 Digital banking is online banking to reach urban esp. Slab rate is applicable. Check the article to know more about how these dividend-paying mutual funds work and also the list of top 10 best dividend paying mutual funds in India.

Employees Provident Fund- Contribution Rate. New Revised TDS Rates Chart Assessment Year 2021-22. The Finance Bill 2021 has introduced one of the key amendments to the EPF Act.

Dividend rate is calculated based ont the lowest dividend declared between the Simpanan. The employees of companies with EPF trust are allotted UAN and Provident Fund number or Member Id. 23rd-Jun-2021 1635 Source.

As per the Union Budget of 2018 below are the various slabs according to which income tax is assessed in various categories of income tax. It has to be relative to that. Dividend rates for Simpanan Shariah will be based on actual performance of the EPFs shariah compliant investments.

It has to give interest to the members at rate declared by the EPFO every financial year. He joined the EPF in 2014 as deputy CEO strategy and subsequently served as CEO from 2018 to February 2021. HDFC Balanced Advantage Fund IDCW Monthly is a Hybrid Mutual Fund Scheme launched by HDFC Mutual FundThis scheme was made available to investors on 11 Sep 2000Prashant Jain Rakesh Vyas is the Current Fund Manager of HDFC Balanced Advantage Fund IDCW Monthly fundThe fund currently has an Asset Under ManagementAUM of 41796 Cr and the Latest NAV as.

Payment of Interest on Securities by company. An Overview of announcement by honorable finance minister Nirmala Sitharaman on Wednesday 13052020 regarding EPF contribution by which EPF Contribution was reduced for Employers and Employees for 3 months to 10 from 12 for all establishments covered by EPFO for next 3 months ie.

Historical Epf Dividend Rates

Epf Needs Rm46 Bil To Pay 5 Dividend For 2020 The Edge Markets

Varied Response To Whether Epf Should Implement Tiered Dividends The Edge Markets

Epf Dividend Rate For 2019 Is 5 45 For Conventional 5 For Shariah

Historical Epf Dividend Rates

What Does The 6 40 Epf Dividend Mean To Your Savings Imoney

Epf Dividend Of 5 Possible 6 May Be Difficult The Edge Markets

Epf Dividends For 2020 Could Be On Par With 2019 Or Just Slightly Less

You have just read the article entitled Epf Dividend Rate 2018. You can also bookmark this page with the URL : https://jamircxt.blogspot.com/2022/07/epf-dividend-rate-2018.html

0 Response to "Epf Dividend Rate 2018"

Post a Comment